HMRC To Issue Child Benefit Letters

Around one million letters will be issued during November to families affected by next year’s changes to Child Benefit.

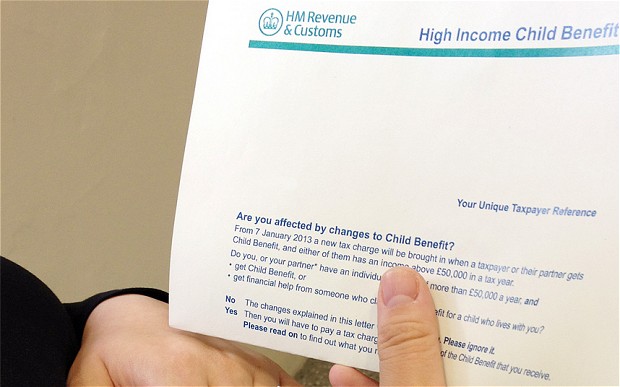

The letters explain the new High Income Child Benefit Charge that takes effect from 7 January 2013.

The new charge will apply when a taxpayer’s or their partner’s income is more than £50,000 in a tax year and if they or their partner receives Child Benefit.

For those with income of more than £60,000, the tax charge is 100 per cent of the amount of Child Benefit. If income is between £50,000 and £60,000, the charge is gradually increased to 100 per cent of the Child Benefit.

Those affected will need to decide whether to keep receiving Child Benefit and pay the tax charge through Self Assessment, or to stop receiving Child Benefit and not pay the new charge.If their income is less than £60,000, the tax charge will always be less than the amount of Child Benefit, and they could lose money to which they are entitled if they stop receiving Child Benefit.

Under the proposed system for implementing the cut, people earning between £50,000 and £60,000 will have to pay the benefits back – on a sliding scale – by filling out complicated self-assessment tax return forms. The “clawback” system will result in around 500,000 people having to fill self-assessment forms for the first time.

More information on the changes and the steps you should follow can be found at