Olympics Helps Great Britain To Get Out Of Recession

There was a better than expected growth in the Uk economy after 2012 Olympics.

Analysts today confirmed that the Olympics has grown the UK economy and strong ticket sales helped the UK exit the longest double-dip recession since the Second World War

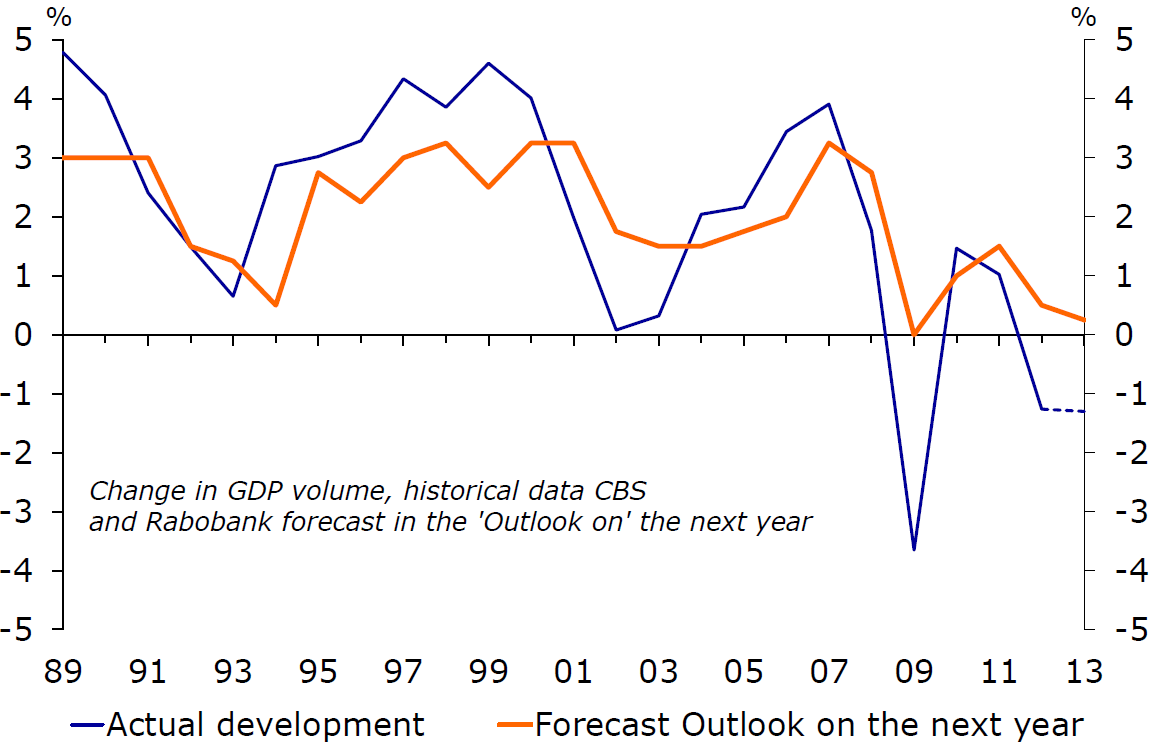

This is the first estimate of how the economy performed in the third quarter of 2012, the Office for National Statistics (ONS) confirmed a return to growth of 1% over the three months following a 0.4% contraction in GDP in the previous period. That was higher than analysts had expected and the strongest quarter of GDP growth for five years.

In addition to 2012 Olympics sales there was another big national event, the Queen’s Diamond Jubilee that stimulate Uk’s economy.

The Olympic 2012 also helped lift a range of other services including employment agencies, creative arts, office administration, accommodation and food and beverages.

Overall the service sector, which takes in 75% of the UK economy, grew by 1.3% in the period while industrial output grew by 1.1%.

Construction sector has shrieked by 2,5% which impacted on GDP results.

This has impact on the construction sector and as you may know there are a lot of construction site that are not completed yet.

This is good news for the Government which are under pressure to stimulate growth.

The Treasury released reaction from the Chancellor, George Osborne via Twitter: “There is still a long way to go but these figures show we’re on the right track and are a sign the economy is healing,” he said.

“We’ve cut the deficit by a quarter, over one million jobs have been created in the private sector, inflation is down and the economy is growing.

“Yesterday’s weak data from the eurozone were a reminder that we still face many economic challenges at home and abroad.

“By continuing to take tough decisions to deal with debt & equip our economy we are laying the foundations for lasting prosperity.”

The better than expected growth now makes it less likely that the Bank of England will look to extend further its policy of Quantitative Easing next month, when most economists had predicted further asset purchases to boost money supply further.

The bank has spent £375bn to date on its asset purchase scheme and its Monetary Policy Committee may decide to adopt a ‘wait-and-see’ approach at its next meeting.

Citigroup economist Michael Saunders mentioned that it was clear the UK faced “serious headwinds” ahead and the possibility of a ‘triple-dip’ recession could not be ruled out because of remaining weaknesses and the threat from the Euro area.